How Is Hawk Different to Other AML and Fraud Prevention Solutions?

In short? We offer explainable AI you can trust, a hybrid approach to rules and AI, a 360° customer view in one system, and integrated risk assessment.

Selected Customers

Here’s Why Compliance and Anti-Fraud Teams Prefer Hawk

Achieve fast time to value and proven efficiency and effectiveness in your financial crime detection capabilities with our robust and flexible platform.

360° Customer View

Explainable AI

Dynamic Risk Rating

Our solutions come with integrated risk assessment, so your Customer Risk Rating is always up-to-date and accurate. This better supports your perpetual KYC capabilities and enables you to further derisk your business without increasing manual effort.

Keep your Rules

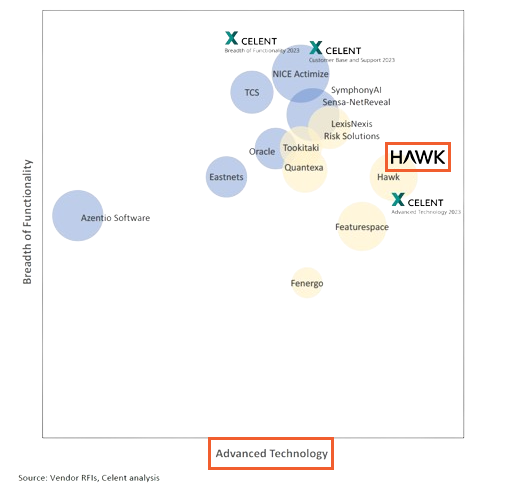

Hawk: An Industry-Leading Software Solution

Hawk is an industry leader in financial crime technology, according to Celent and VendorMatch.

Selected Awards & Certifications

.png?width=1200&height=720&name=deloitte_fast50_web%20(1).png)

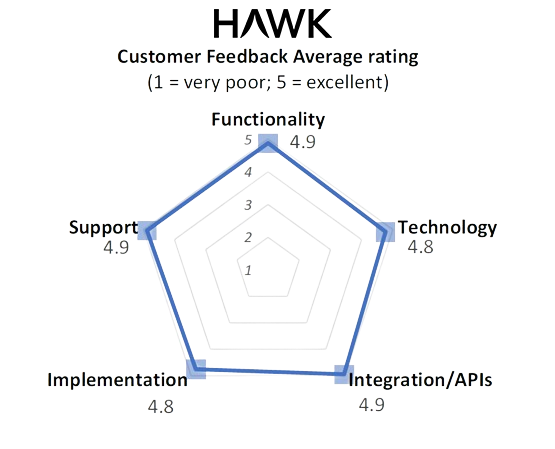

See Why Customers Love and Trust Us

“The Hawk team demonstrated their technology leadership and willingness to work closely with our teams to hit ambitious goals. We look forward to a strong relationship that ensures the highest level of AML compliance.”

Mirko Krauel.

CEO, OTTO Payments

Hear From CSI on Why They Chose Hawk for Their Bank Customers

Learn More About Hawk

How Does AI Reduce False Positives in AML?

Artificial Intelligence (AI) is essential for detecting financial crime. But how does it improve anti-money laundering (AML) processes and operations? AI reduces false positives and finds more suspicious behavior than rules-based technology. By doing so, AI empowers financial institutions (FIs) to take a better-informed, risk-based approach to AML.

Hawk Hailed as Transaction Monitoring Leader in Celent Report

How Explainable AI Supports Model Validation

AML model validation is an essential element of a model risk governance process. Hawk supports our clients to meet their obligations by providing evidence of the accuracy and effectiveness of our models.

Find out how Hawk can help your anti-financial crime operation.

Request a Demo.