The #1 Fraud Prevention Solution for Banks and FinTech

Hawk helps you detect and act on evolving fraud patterns through agile rule testing, real-time transaction monitoring, and best-in-class explainable AI

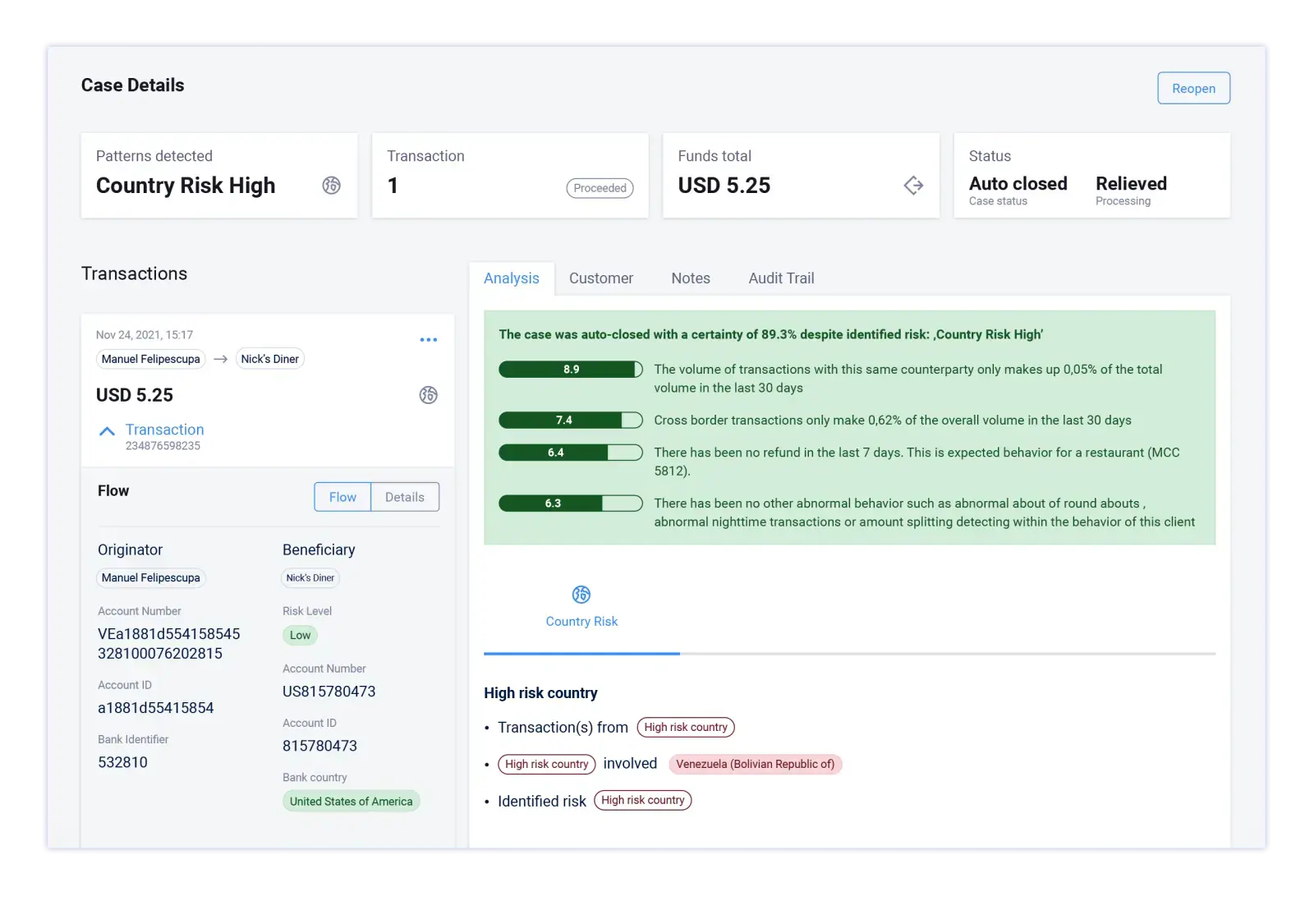

Act on real cases, in real time

Prevent and mitigate transaction fraud in real time by quickly identifying the mix of custom rules and explainable AI that works best for your business

Monitor across channels

Detect fraudulent patterns across all channels and payment methods, including chargebacks, card-not-present fraud, scams, and account testing schemes.

Implement & configure with ease

Whether you're starting from scratch, replacing your legacy system, or supercharging your existing one, we have the right solution and can get you started quickly

Get a 360° view of your risk

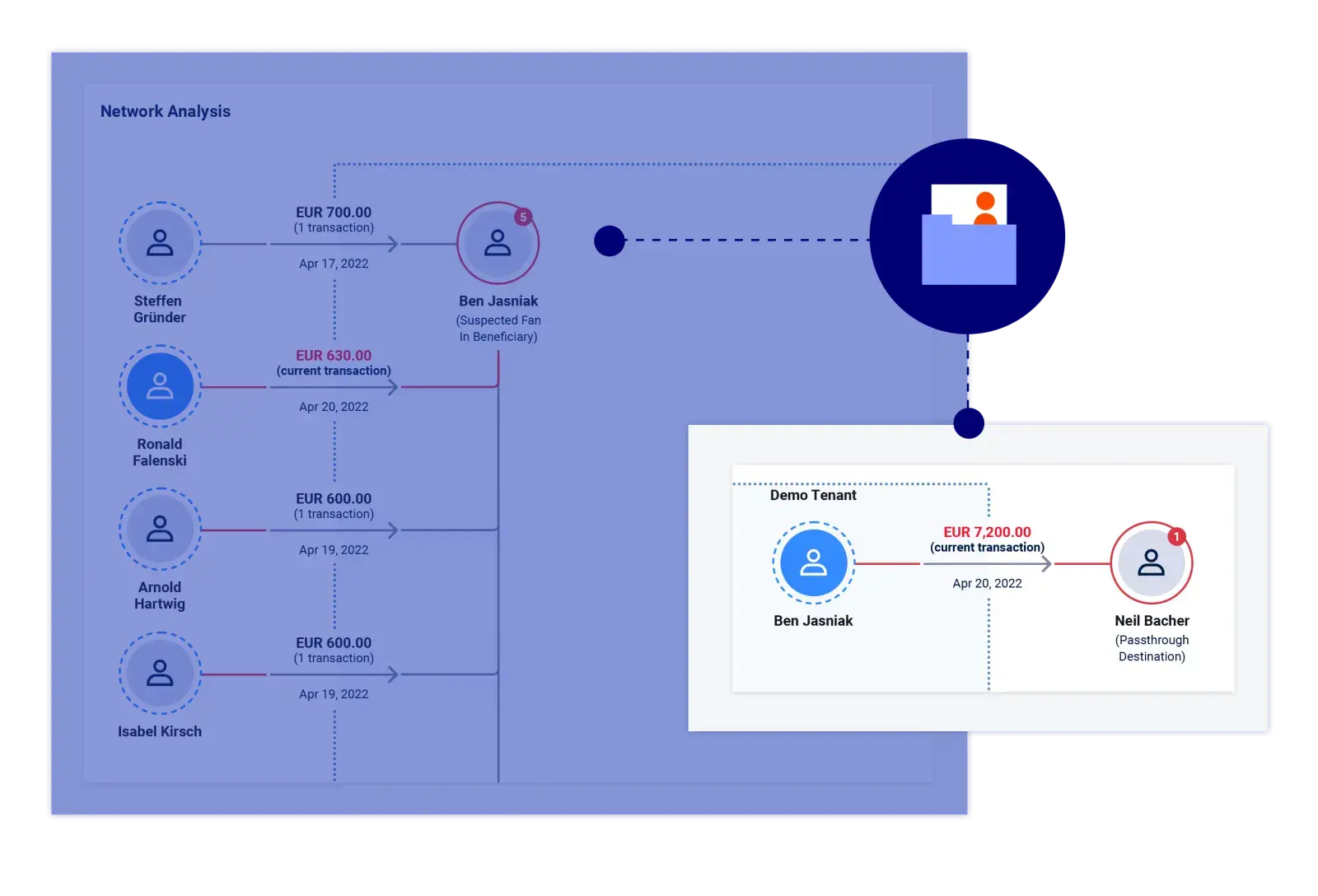

Hawk's AI-powered technology combines state-of-the-art AML and fraud detection to provide a holistic view of your risk. By combining Customer Screening, Customer Risk Rating, AML Transaction Monitoring, Fraud Prevention, and Payment Screening in one system, compliance officers can consolidate their work and avoid data silos.

Reduce customer friction

Blocking legitimate transactions can result in friction during the customer journey. Hawk uses traditional rules augmented with AI to reduce false positives, leading to fewer upset customers. Our AI models are constantly retrained with operator feedback and cross-institutional learnings, understanding normal customer behavior and effectively identifying falsely alerted cases.

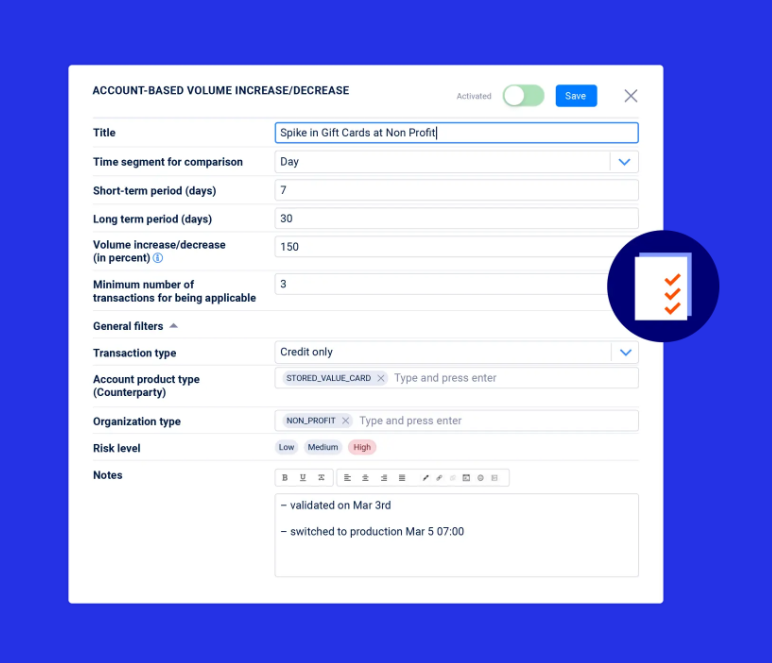

Configure & customize rules

With Hawk's modern, intuitive no-code user interface, you can create and customize rules without developer or vendor input, making your rule-testing as efficient and effective as ever.

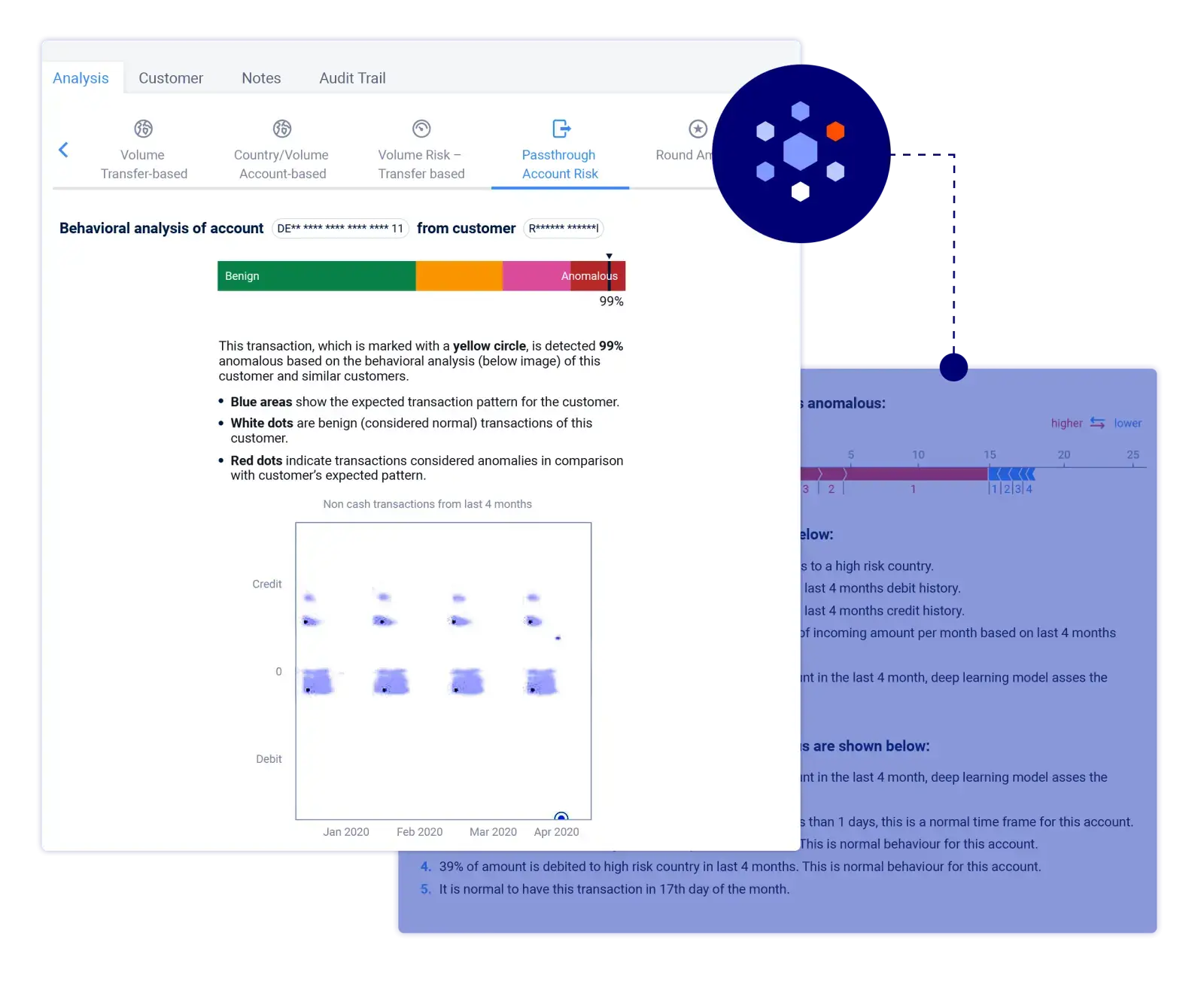

Detect 3X more behavioral anomalies

Hawk models learn customer transaction patterns, allowing for the detection of fraud without the need for fixed thresholds.

- Catch deviations from normal customer behavior in the context of similar customers in their peer group

- Detect and prevent new, emerging fraud patterns

.png?width=1200&height=720&name=deloitte_fast50_web%20(1).png)

Ready to see Hawk in action?

The Hawk Story

Hawk was founded in Munich in 2018 by experienced fintech entrepreneurs Wolfgang Berner and Tobias Schweiger, who saw the potential for an AI-driven approach to technology for AML and regulatory compliance.

"Back in 2018, banks would ask why or if they should introduce AI. Today, FinTech companies and financial institutions like EcoBank, Worldline or CSI turn to us asking when and how they can use AI to help their financial crime operations.

We're proud to have led the way for AI in the financial crime industry and we continue on our mission to become the gold standard in AML worldwide, bringing cost savings to our customers as we help them fight financial crime effectively."

Alvin Rogers is a highly accomplished and sought-after speaker, renowned for their expertise and captivating stage presence. With a diverse background in [relevant field or industry], they bring a wealth of knowledge and experience to every speaking engagement. Their dynamic and engaging style seamlessly combines powerful storytelling with actionable insights, leaving audiences inspired and equipped with practical strategies for success. Alvin has delivered impactful keynote addresses at prestigious conferences and corporate events worldwide, consistently receiving rave reviews for their ability to connect with and energize audiences. Whether addressing topics such as [specific areas of expertise], leadership, or innovation, Alvin is dedicated to empowering individuals and organizations to reach their full potential.

Lisa Smith is a highly accomplished and sought-after speaker, renowned for their expertise and captivating stage presence. With a diverse background in [relevant field or industry], they bring a wealth of knowledge and experience to every speaking engagement. Their dynamic and engaging style seamlessly combines powerful storytelling with actionable insights, leaving audiences inspired and equipped with practical strategies for success. Lisa has delivered impactful keynote addresses at prestigious conferences and corporate events worldwide, consistently receiving rave reviews for their ability to connect with and energize audiences. Whether addressing topics such as [specific areas of expertise], leadership, or innovation, Lisa is dedicated to empowering individuals and organizations to reach their full potential.

James McGiven is a highly accomplished and sought-after speaker, renowned for their expertise and captivating stage presence. With a diverse background in [relevant field or industry], they bring a wealth of knowledge and experience to every speaking engagement. Their dynamic and engaging style seamlessly combines powerful storytelling with actionable insights, leaving audiences inspired and equipped with practical strategies for success. James has delivered impactful keynote addresses at prestigious conferences and corporate events worldwide, consistently receiving rave reviews for their ability to connect with and energize audiences. Whether addressing topics such as [specific areas of expertise], leadership, or innovation, James is dedicated to empowering individuals and organizations to reach their full potential.

-1.webp)

Alvin Rogers is a highly accomplished and sought-after speaker, renowned for their expertise and captivating stage presence. With a diverse background in [relevant field or industry], they bring a wealth of knowledge and experience to every speaking engagement. Their dynamic and engaging style seamlessly combines powerful storytelling with actionable insights, leaving audiences inspired and equipped with practical strategies for success. Alvin has delivered impactful keynote addresses at prestigious conferences and corporate events worldwide, consistently receiving rave reviews for their ability to connect with and energize audiences. Whether addressing topics such as [specific areas of expertise], leadership, or innovation, Alvin is dedicated to empowering individuals and organizations to reach their full potential.

Lisa Smith is a highly accomplished and sought-after speaker, renowned for their expertise and captivating stage presence. With a diverse background in [relevant field or industry], they bring a wealth of knowledge and experience to every speaking engagement. Their dynamic and engaging style seamlessly combines powerful storytelling with actionable insights, leaving audiences inspired and equipped with practical strategies for success. Lisa has delivered impactful keynote addresses at prestigious conferences and corporate events worldwide, consistently receiving rave reviews for their ability to connect with and energize audiences. Whether addressing topics such as [specific areas of expertise], leadership, or innovation, Lisa is dedicated to empowering individuals and organizations to reach their full potential.

James McGiven is a highly accomplished and sought-after speaker, renowned for their expertise and captivating stage presence. With a diverse background in [relevant field or industry], they bring a wealth of knowledge and experience to every speaking engagement. Their dynamic and engaging style seamlessly combines powerful storytelling with actionable insights, leaving audiences inspired and equipped with practical strategies for success. James has delivered impactful keynote addresses at prestigious conferences and corporate events worldwide, consistently receiving rave reviews for their ability to connect with and energize audiences. Whether addressing topics such as [specific areas of expertise], leadership, or innovation, James is dedicated to empowering individuals and organizations to reach their full potential.