Celent x Hawk Report

Trends in Fraud & AML Convergence at US Mid-Market Banks & Credit Unions

A comprehensive overview of how mid-market banks and credit unions in the United States are perceiving and approaching the convergence of fraud and AML

More than half of US mid-market banks and credit unions see the practical and economic value of a FRAML approach and have already taken steps in the direction of fraud and AML convergence

Why is a FRAML approach becoming necessary?

Pros of adopting a FRAML approach

Learn about the current state of FRAML in US mid-market banks and credit unions

Despite growing interest, most financial institutions struggle with consolidating their fraud and AML efforts, the main challenges being:

In order for mid-market financial institutions to reap the benefits of fraud and AML convergence, they need a solution built to enable a true FRAML approach

The Unsustainable Way

The Hawk Way

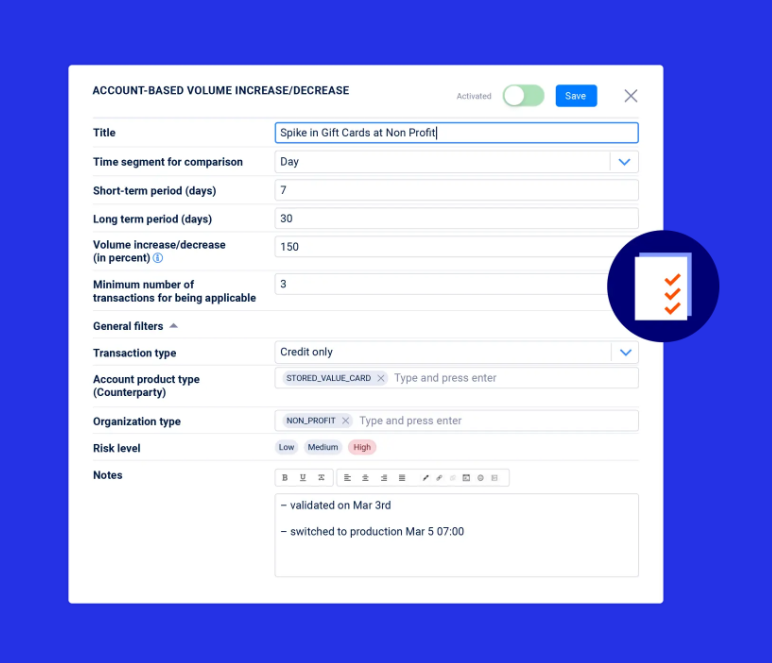

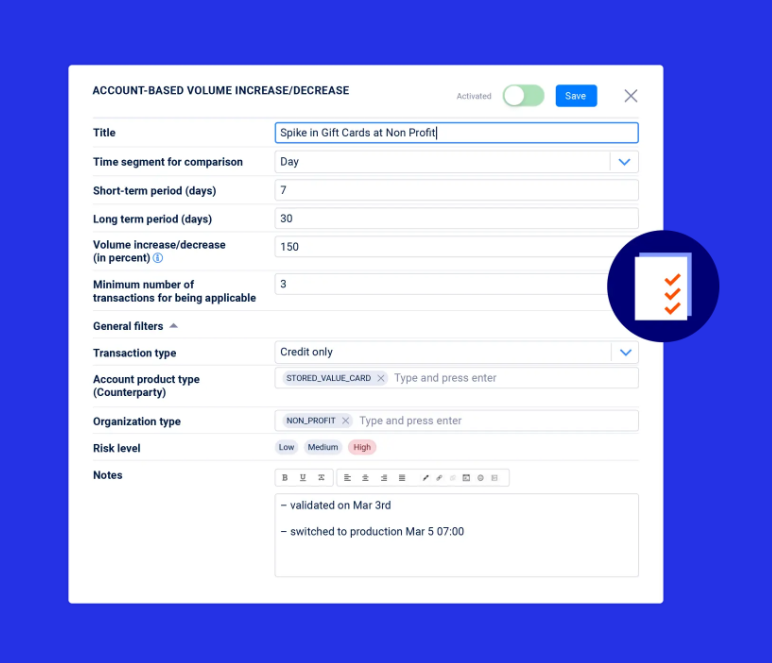

Address risks at speed

Hawk blocks suspicious transactions in true real-time (200ms), allowing you to optimize rule coverage with self-serve rule configuration and sandbox testing.

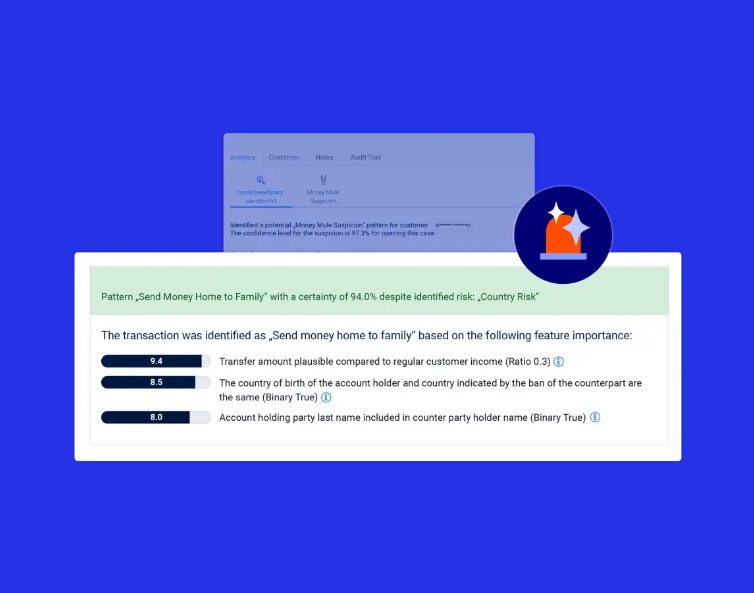

Strengthen defenses without adding complexity

Sharpen threat detection and slash false positives with AI. The clarity of the explanations simplifies investigations and significantly improves decision-making.

Streamline Operations

Reduce maintenance and accelerate investigations with a single, consolidated system.

Celent x Hawk Report

Trends in Fraud & AML Convergence at US Mid-Market Banks & Credit Unions

Discover:

> How US mid-market banks and credit unions view and approach the convergence of fraud and AML

> The estimated ROI of a FRAML approach

> Pros & cons of consolidating your fraud and AML processes

> How to leverage AI for Fraud and AML